Deliver a personalized member experience across all touchpoints

Members can effortlessly apply for loans and open deposit accounts—and prospective members can join your credit union—online, anytime.

A member-first digital experience with Origence arc DX

Transform your digital ecosystem

Employ our online banking and core integrations for a seamless digital account opening and consumer lending experience.

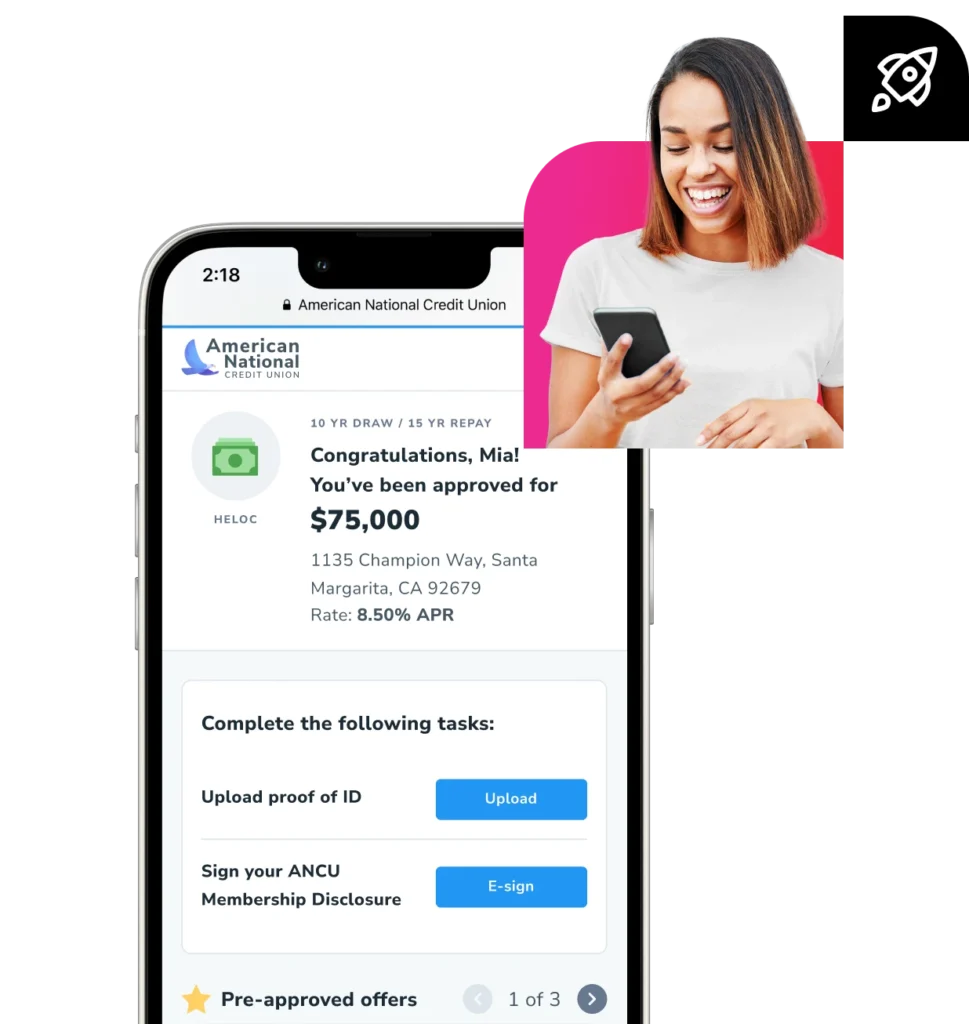

Enable an end-to- end experience

Members can apply, finalize loans and deposit accounts, satisfy stipulations, and e-sign all on a single platform.

Personalize lending with a click

Leverage application prefills with host banking, core, and 3rd party database integrations.

Be everywhere, all at once

Offer your members a true omni-channel solution with online, SMS, and in-branch services that stay consistent through the experience.

For every step of the digital journey

- Status updates, reviews and notifications

- Upload documents

- Real-time decisioning

- Embedded eSign functionality

- Integrated same-session account funding

- Personalized cross-sell capabilities

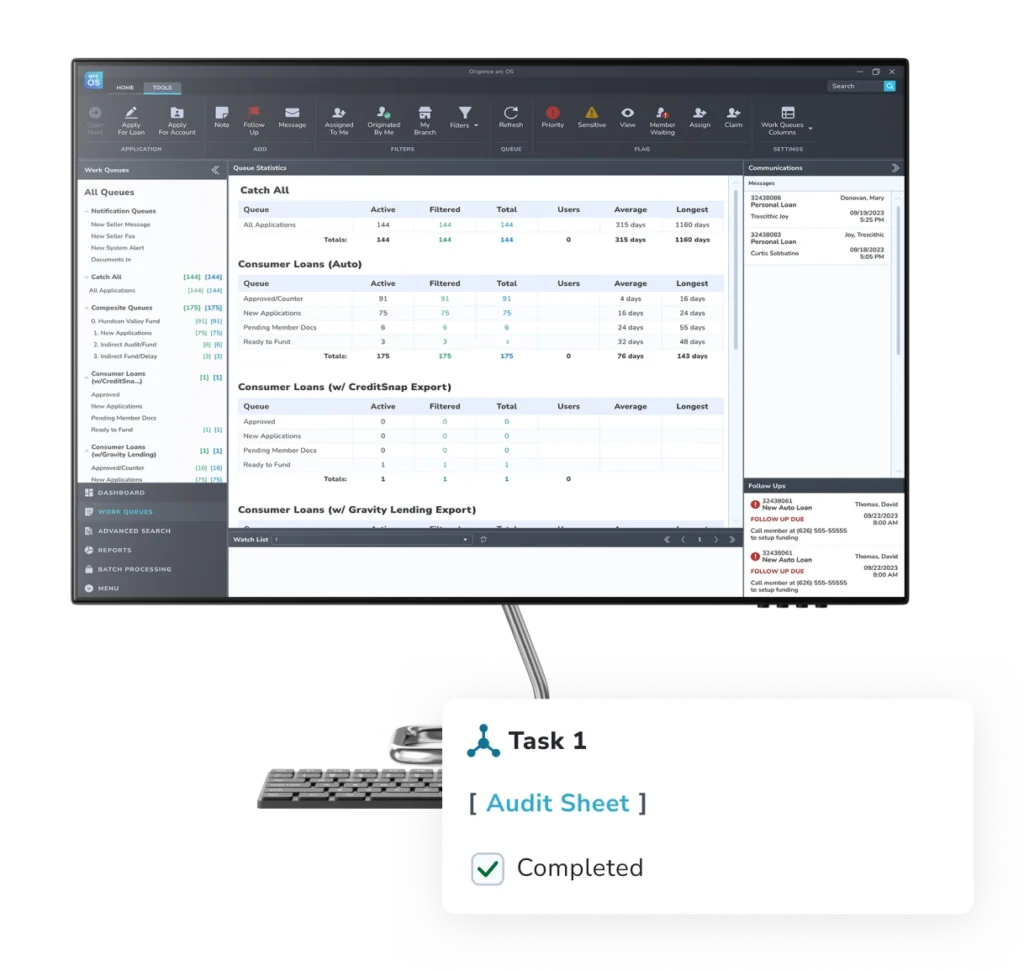

In perfect harmony with arc OS origination

Origence arc DX integrates seamlessly with Origence arc OS for a true end-to-end origination platform that covers the entire member origination journey. Featuring automated underwriting, drag and drop workflow configurability, an AI-driven decision engine, and a deep library of modern integrations, arc OS brings everything together in a powerful single platform origination solution.

Anywhere, anytime online applications

Extend your lending and deposit account services online, while maintaining complete control over your online applications with brand-configurable capabilities.

- Versatile across multiple devices: desktop, laptop, tablet, and mobile

- Optimized for mobile responsiveness on major browsers

- White-labelled to manage your brand, voice, and tone

- Customizable application templates and content editors

- Streamlined with integrated pre-fill and single sign-on options

- Differentiated new member vs. existing member experiences to optimize efficiency

No paper, no manual entry, and no overhead costs

We’ve integrated digital account opening, membership applications, and consumer lending origination all within the arc DX experience. It’s your reliable solution to onboarding with no paper, no manual entry, and no overhead costs.

High accuracy and immediate results

We're here to help.

Learn more about growing and modernizing your lending operations.

Trending content

-

State ECU Partnered with Origence and Strengthened its Indirect Lending ProgramRead more

State ECU Partnered with Origence and Strengthened its Indirect Lending ProgramRead more -

-