Fast decisions. Streamlined F&I. Closed deals.

Drive deals with the credit application solution built to make credit union financing faster and easier. Bring your financing together with eContracting, DMS integration, and smart digital tools—all powered by a dealer-friendly platform.

Drive results with modern F&I efficiency.

Click below to explore:

Digital contracting

Streamline the deal process with eContracting for CUDL®, enabling faster funding and fewer errors.

DMS integration

Connect your dealership management system directly to the CUDL platform for a more efficient workflow.

SmartFund®

Accelerate funding with SmartFund and gain real-time visibility into funding status—reducing delays.

Second Look™

Give customers with credit scores under 640 a second chance at approval—automatically.

Digital deal queue

Manage and track deals in real time with Deal Queue, helping your team stay organized and responsive.

Payoff solution

Get accurate vehicle payoff quotes, so that your team can close deals faster with fewer manual steps.

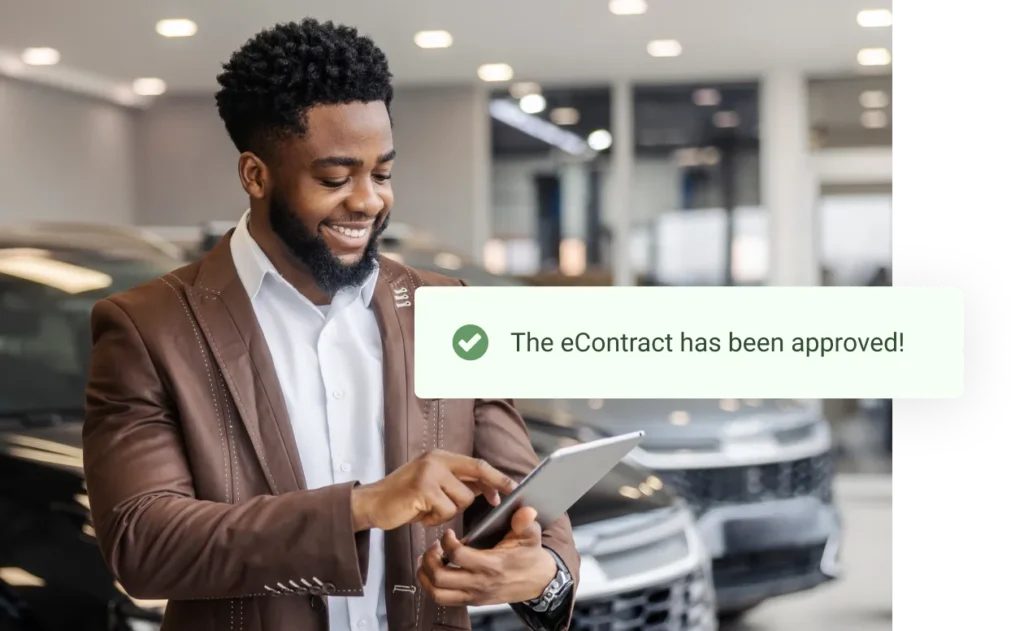

Digitally transform your contracting for a better bottom line.

eContracting helps dealers fund faster, cut rework, and streamline the F&I process—giving your team more time to focus on closing deals and serving customers.

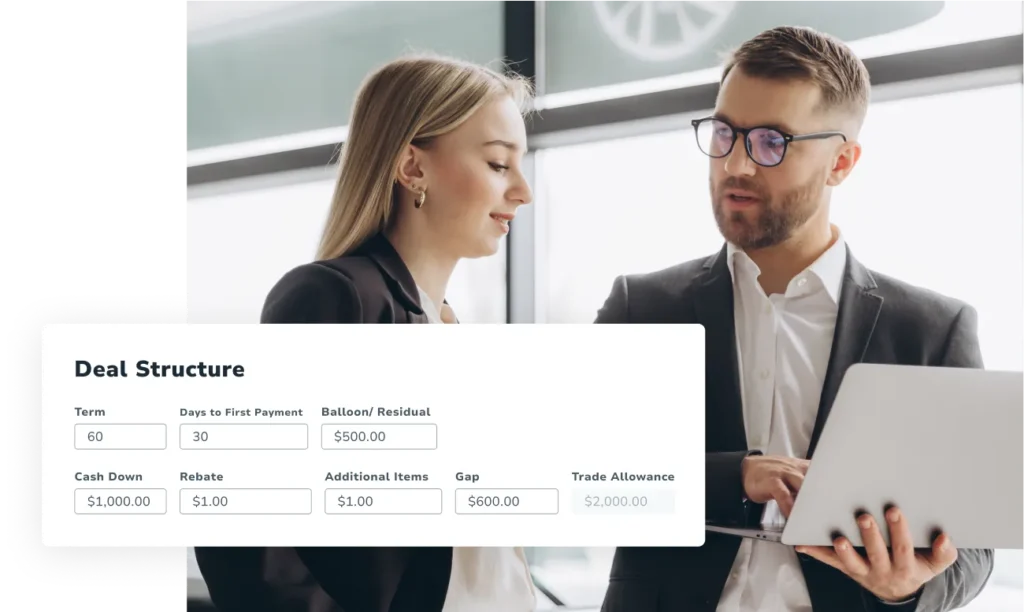

Connected systems. Faster closings.

Your dealership runs on speed and accuracy—your systems should too. CUDL connects your workflows through powerful DMS and CRM integrations, giving you real-time data syncs that simplify every step from application to funding.

- Sync deal information automatically.

- Reduce manual entry and eliminate duplicate records.

- Increase productivity and strengthen your bottom line.

- Send complete, accurate information to your lenders.

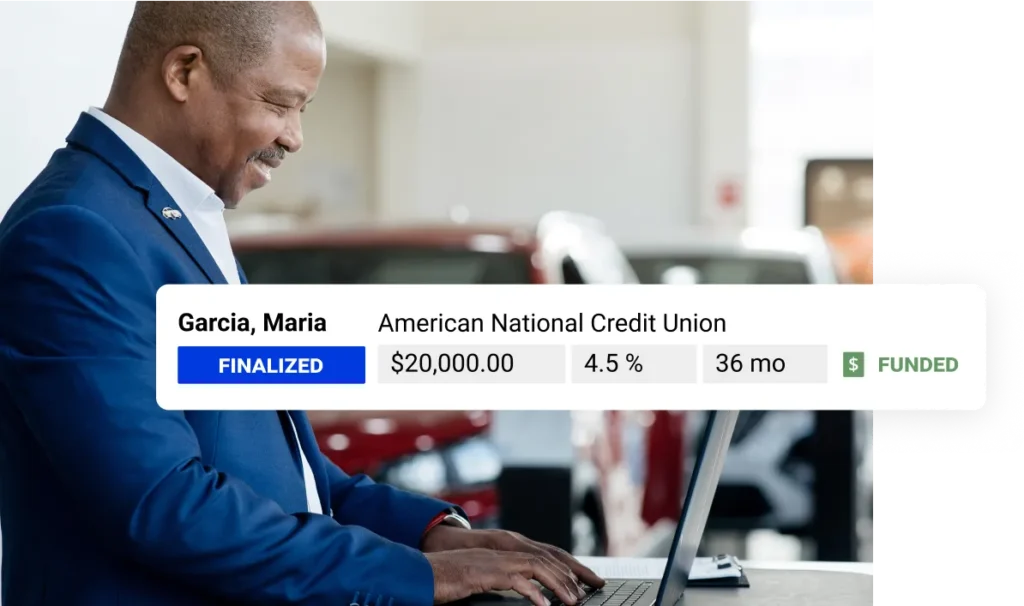

Digital documents. Less delays.

Enhance the experience for your customers and expedite processes for your lending partners. Digitally upload and transmit loan documents to credit unions through SmartFund to streamline loan package delivery and achieve faster funding.

Go from "Decline" to "Approval" in seconds.

Fund more loans for credit scores under 640 with automatic opt-in, access to non-prime lenders, and automated approvals in under 60 seconds.

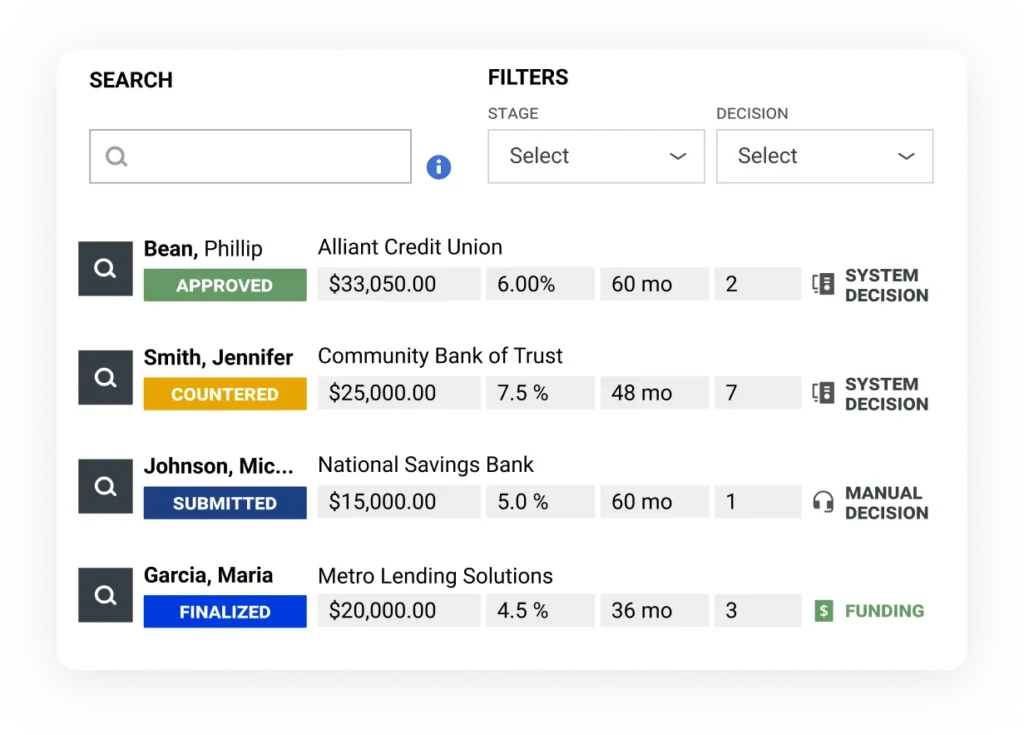

All deals. One view. Total control.

Manage every deal from a single, streamlined dashboard. Centralize applications, communication, and status updates in one place—helping your team track progress, spot issues early, and keep every deal moving without delay. Gain full visibility across your pipeline, reduce manual effort, and accelerate funding with quick access to credit union updates.

Automate payoffs. Accelerate trade-ins.

Get prompt, accurate payoff quotes—no manual calculations, no waiting. With real-time access to secure credit union data, dealers reduce guesswork and streamline the trade-in process. That means faster deals, smoother experiences, and more satisfied customers.

Cut risk, control costs, and simplify compliance.

Keep deals moving forward—faster—with Informativ’s Total Solution for CUDL, streamlining credit pulls, compliance, and fraud prevention for a more efficient, secure path from lead to funding

- Quick qualification and buyer insights

- Fast, multi-layered fraud detection

- Flat rate credit and compliance

- Digital deal jacket creation and storage

Make your next deal your fastest yet.

Speed up approvals, simplify financing, and close deals faster.