What a year 2022 was. Origence and our partner credit unions worked diligently to serve the diverse and ever-evolving financial needs of members across the country. As 2023 begins, I’m pleased to say that Origence helped credit unions not only meet the challenges of last year… but actually exceed all expectations.

It was a record year for Origence and many of our credit unions. In 2023, Origence is in a prime position for continued success… and we can’t wait to get started!

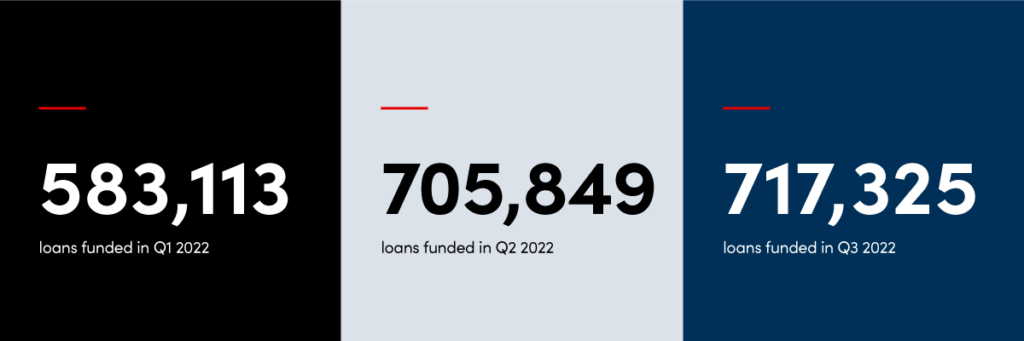

Credit Unions Funded a Record Amount of Loans Through Origence

We began the year with a record-breaking first quarter. Credit unions funded 583,113 loans through Origence arc OS and CUDL indirect lending platforms. Our second quarter’s successes were right around the corner: credit unions blew us away again by funding another 705,849 loans through Origence and CUDL.

The third quarter came in hot, with credit unions funding 717,325 more loans with us, for a total of over 2 million loans through Q3. Every time a new record was set, we broke it. In fact, going back to 2021, we can now celebrate four record quarters in a row!

On the dealer side, the 1,100 CUDL credit unions remain the #1 auto lender by aggregate – as they have been for the last five years. With 2022 in the books, CUDL credit unions continue to be one of the strongest forces in auto lending!

In 2022, We Positioned Our Brand for the Future

This was one of the most exciting years in the history of our company. We rebranded from CU Direct to Origence, signifying to the entire industry our commitment to create the ultimate origination experience that will help credit unions win in a digital-first world.

We kicked off the most successful event we have ever had, Lending Tech Live ’22, with an amazing line-up of expert speakers from the worlds of lending, automotive, and finance.

And don’t forget that we launched Origence arc, the most advanced product offering in our company’s history. Origence arc combines arc OS (formerly Lending 360), the all-new arc DX digital experience, and arc MX (formerly Intuvo) to create the ultimate end-to-end loan and account origination, digital experience, and marketing automation platform. These services empower credit unions to configure an advanced, seamless, and responsive experience that meets the needs of their members.

New strategic partnerships helped Origence grow even stronger. Zest AI’s advanced machine learning technology enhances loan decisioning capabilities for our consumer lending platform. Informed.IQ was implemented into Origence’s Document Process Automation tools, and we partnered with Eltropy to integrate lending communication capabilities into Origence arc OS.

Thank You, Origence Nation!

I am incredibly proud of my team. Last year, I witnessed people coming together, sharing solutions, and taking action. Together, we have more room to grow, new goals to achieve, and an industry that we will continue to shape.

To everyone with Origence and all our industry partners, I wish you a fantastic start to 2023.

Thank you all.