10 ways credit unions are winning the indirect lending game with Origence—on their own terms.

Real success stories. Real Results.

Discover how credit unions across the country are transforming their indirect lending programs with Origence. From tripling loan volume to cutting processing time in half, these are the voices of your peers—sharing what’s working, what’s driving membership, and what’s next. These insights—drawn from credit union leaders who have seen measurable results—highlight what it takes to compete and succeed as the pace of digital lending accelerates.

Rapid loan volume growth

Expansive dealer network and local support

Eliminate manual work with automation that scales

Automate and streamline decision making

Higher look-to-book ratios

Network of seamless integrations

Faster funding with SmartFund®

Improving member acquisition and retention

Easy onboarding

Expert CUSO support

Credit union wins: Indirect lending, direct impact

Indirect lending is a proven growth engine for credit unions—expanding loan portfolios, attracting new members, and strengthening market presence through strategic dealer partnerships. Lasting success requires more than access to dealers; it demands a scalable, automated infrastructure that integrates seamlessly with core systems and is backed by a partner who understands the unique needs of credit unions.

Origence Indirect Lending delivers exactly that—connecting credit unions to the nation’s largest dealer network while providing intelligent automation, advanced decisioning tools, and a technology framework built for speed and scale—while retaining full control over your lending strategies.

Rapid loan volume growth

An indirect lending program has the potential to become one of the most powerful engines of growth for a credit union—but only when supported by the right platform. As loan demand increases, so does the opportunity to reach new members, strengthen dealer relationships, and grow market share. The challenge is doing so efficiently and sustainably.

By combining intelligent automation, seamless system integration, and fast, consistent decisioning, Origence empowers lending teams to manage high volumes without sacrificing accuracy or speed. From application to funding, every step is optimized to eliminate friction and accelerate performance.

The results speak for themselves. Credit unions leveraging Origence have reported significant increases in loan volume—achieved not by expanding staff or overextending resources, but by automating routine tasks, reducing manual intervention, and streamlining end-to-end processes. This creates a positive cycle: faster service strengthens dealer partnerships, increased throughput boosts loan portfolios, and operational efficiency frees up staff to focus on strategic growth.

Record-breaking loan growth

Honor Credit Union tripled its annual loan volume since adopting CUDL.

Service Credit Union increased monthly originations from $4-5M to $30-40M.

First Financial Maryland FCU booked $16.8M in loans within just seven months.

Why it matters

Sustained loan volume growth is more than a metric—it’s a driver of long-term success. For credit unions, it means the ability to serve more members, deepen dealer relationships, and reinvest in the technology and talent needed to thrive. Origence helps make that possible by removing the operational barriers to scale. With strategic automation, seamless processes, and faster decision-making, credit unions can grow loan volume without increasing their workload.

Discover the platform fueling credit union growth.

Expansive dealer network and local support

A strong dealer network is essential to any high-performing indirect lending program. Every dealer connection opens the door to new opportunities: more loans, broader membership reach, and stronger long-term partnerships. Through the CUDL platform, Origence helps credit unions connect with nearly 20,000 dealerships nationwide—one of the largest networks in the industry.

Access to a vast network is only part of Origence’s formula for credit union success. What sets Origence apart is the local, on-the-ground support offered to both credit unions and dealers. Dedicated client success teams and dealer representatives work closely with credit unions and their dealer partners to strengthen relationships, identify growth opportunities, and provide tailored guidance. This proactive, regional model ensures that dealers stay engaged, credit unions stay visible, and the loan pipeline stays strong.

The result is more than just expanded reach—it’s the ability to form lasting, reliable partnerships that consistently deliver high-quality, high-volume originations. With Origence, credit unions aren’t just plugged into a network—they’re supported by a team that helps them maximize their full potential.

Expanding reach through stronger dealer relationships

BluCurrent Credit Union expanded from 30 to over 70 dealership partnerships.

Sound CU benefited from established, reliable dealer relationships forged by Origence.

Honor Credit Union doubled its number of dealer partners and has access to over 450 more.

Why it matters

Every dealer connection opens the door to new opportunities: more loans, broader membership reach, and stronger long-term partnerships. With seamless communication tools and localized support teams, Origence helps credit unions build relationships that go beyond transactions. This leads to greater dealer loyalty, improved loan quality, and a more consistent member experience—all driving sustainable, scalable growth.

Ready to put your credit union at the top of every dealer’s list?

Did you know?

Credit unions can use CUDL for their indirect lending program even if they’re on an LOS other than arc OS. That means more ways to tap into the nation’s largest credit union auto financing network, strengthen dealer relationships, and deliver faster funding experiences.

Eliminate manual work with automation that scales

Document processing automation opens the door to faster, more accurate indirect lending. By streamlining workflows and reducing manual touchpoints, credit unions can turn common operational challenges into strategic advantages. What once slowed things down—document review, validation, and funding—can now become opportunities to increase efficiency, enhance member and dealer satisfaction, and position the credit union as a responsive, trusted lending partner.

Powered by Informed.IQ, Origence’s automation solution uses machine learning and artificial intelligence (AI) to process, validate, and deliver loan packages with speed and precision. Documents are evaluated against lender-specific rules, fraudulent patterns, and more than 100 auto lending-specific document types—reducing the need for manual review while improving accuracy.

Increase efficiency by freeing staff to focus on high-value tasks, not paperwork.

Scale resources quickly in response to fluctuating loan volumes.

Catch errors earlier and ensure consistency across all loan packages.

Enhance fraud protection, including detecting falsified pay stubs with 99.8% accuracy.

Saving time and resources with powerful AI

Credit Union of Colorado cut funding time per loan from 12 to 6 minutes or less.

Sound Credit Union reduced overall processing time by 50%.

Consumers Credit Union improved document quality and expedited service.

Why it matters

Strategic document processing automation helps credit unions modernize back-office operations and meet the fast pace of indirect lending. Streamlined approvals, fewer errors, and stronger fraud protection lead to better service for dealers, helping credit unions stand out in a crowded market. It’s not just about efficiency; it’s about building a reputation for speed, reliability, and trust.

Ready to reduce your funding time?

Automate and streamline decision making

Loan decisioning is one of the most critical points in the indirect lending process. It’s where every application turns into either an opportunity gained—or lost. For credit unions, striking the right balance between speed, accuracy, and risk management is essential.

Origence Indirect Lending brings together leading AI partners—like Zest AI, Experian, Scienaptic, and Informed.IQ—to deliver advanced automated decisioning directly within arc OS, built for today’s credit union needs. Using real-time data and AI-driven algorithms, credit unions can process more applications, accelerate approvals, and make more inclusive credit decisions.

This isn’t just about speed—it’s about elevating the entire underwriting experience. With over 1,800 configurable variables, credit unions can create the ideal decisioning strategy to align precisely with their risk appetite and lending goals. Tools like predictive modeling, scenario testing, and real-time adjustment give lenders the ability to fine-tune policies on the fly—ensuring decisions are both fast and well-informed.

1,800 configurable variables

User-friendly interface

Predictive modeling

Intelligent automation

Scenario testing

Real-time adjustments

The power of a modern decision engine

BluCurrent Credit Union can now instantly decision half of its applications without manual intervention.

Service Credit Union transformed its decision engine and discovered $50M in previously overlooked opportunities.

Honor Credit Union tripled its loan volume without adding underwriting staff, thanks to the automated decision engine in arc OS.

Why it matters

When credit unions make faster, smarter decisions, everyone wins. Dealers receive quicker approvals, members get faster answers, and internal teams operate more efficiently. With Origence arc OS decision, credit unions gain the tools to optimize risk assessment, approve more loans with confidence, and maintain strong portfolio performance—all while reducing manual underwriting effort.

Ready to write your own success story?

Did you know?

Credit unions retain complete control over loan decisions, approval criteria, and dealer relationships when using Origence for indirect lending. Our platform gives you the technology to streamline workflows, automate processes, and scale efficiently—without sacrificing oversight or flexibility.

Higher look-to-book ratios

Submitting applications is just the beginning—the real opportunity lies in converting them into funded loans. That’s where the true value of an indirect lending program is measured. A high volume of applications may look impressive, but if those approvals aren’t leading to contracts, credit unions risk wasting time, depleting resources, and losing dealer trust.

Origence helps credit unions close that gap. Through intelligent automation, real-time analytics, and targeted decisioning strategies, credit unions can zero in on qualified applications and eliminate the noise. It’s not just about volume—it’s about turning the right applications into real opportunities for growth.

From applications to funded loans

Communication FCU improved its look-to-book ratio and saved valuable time.

Honor Credit Union improved its look-to-book ratio from 18% to 30-35%.

Why it matters

Higher look-to-book ratios maximize credit unions’ resources by eliminating wasted time on unqualified applications. This improves efficiency, reduces costs, and strengthens relationships with members and dealers.

Save time and improve your loan quality.

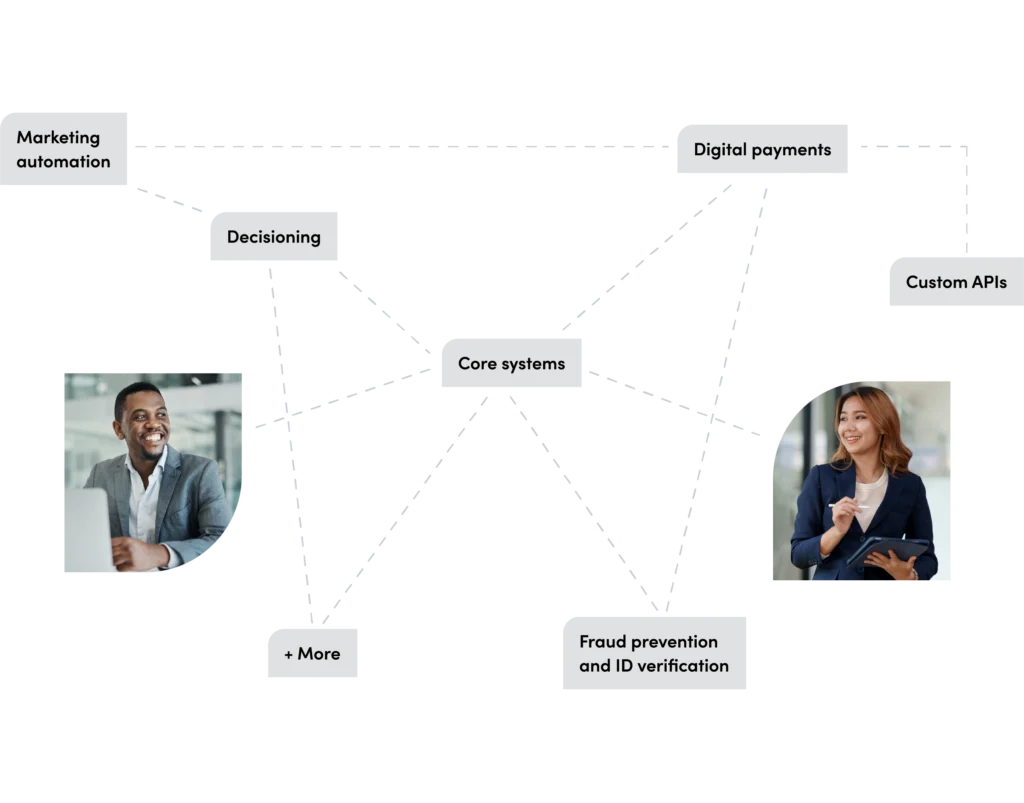

Network of seamless integrations

For an indirect lending platform to drive real results, it must fit effortlessly into a credit union’s existing ecosystem. Origence Indirect Lending is built with seamless integration in mind—connecting directly to core systems and essential partners to streamline operations, minimize manual workloads, and enhance efficiency across the board.

Origence supports seamless integration with a range of industry partners and platforms. Click below to explore:

Real-time sync with core systems to keep loan origination and servicing aligned, reducing duplication and delays.

Zest AI, Experian, Scienaptic, and Informed.IQ help automate decisions and boost underwriting accuracy.

Solutions such as Equifax InstaTouch, Experian Precise ID, and TransUnion TruValidate enhance security and compliance.

Eltropy supports personalized member engagement and communication.

Integration with iCheckGateway.com (iCG) supports seamless payment collection and loan funding.

Origence Connect APIs offer flexible integration points for everything from GAP refunds to document uploads.

With over 100 integration partners, Origence continually expands its ecosystem to meet evolving credit union needs.

Zest AI, Experian, Scienaptic, and Informed.IQ help automate decisions and boost underwriting accuracy.

Eltropy supports personalized member engagement and communication.

Integration with iCheckGateway.com (iCG) supports seamless payment collection and loan funding.

Origence Connect APIs offer flexible integration points for everything from GAP refunds to document uploads.

With over 100 integration partners, Origence continually expands its ecosystem to meet evolving credit union needs.

Smart system connections in action

SunWest CU streamlined lending operations leveraging key integrations.

BluCurrent Credit Union reduced workload and funding time by 50% through integration.

Why it matters

When systems connect intelligently, lending becomes faster, simpler, and more accurate. Seamless integration with core systems and key platforms eliminates duplicate entry, reduces errors, and streamlines workflows—allowing teams to focus on high-value work instead of routine tasks.

What if your lending tools integrated seamlessly?

Faster funding with SmartFund®

Timely dealer funding doesn’t just close the loop on a loan—it builds trust, strengthens partnerships, and keeps your credit union top of mind. Built into Origence Indirect Lending, SmartFund streamlines the funding process by allowing dealers to electronically upload loan documentation in real time.

In 2024 alone, credit unions funded over $40 billion in auto loans digitally through SmartFund.

Funding dealers faster—and building loyalty

Service Credit Union enhanced dealer communication and reduced funding delays.

“SmartFund has allowed us to enhance our service delivery and streamline our operations because it gives us an instant point of contact to the dealer. We can communicate with them directly and immediately while also reviewing pertinent vehicle loan documentation, getting that answer to the member and the dealer faster so we can meet our SLAs.”

Heather Defourney

EVP of Consumer Lending

Service Credit Union

Why it matters

By eliminating paper-based delays and reducing the back-and-forth around missing documentation, SmartFund accelerates processing times and simplifies the post-approval workflow. Dealers get paid faster, credit unions reduce overhead, and both parties benefit from a smoother, more transparent experience.

Ready to fund faster?

Improving member acquisition and retention

Indirect lending is more than just a tool for growing loan portfolios; it’s a powerful strategy for acquiring new members and keeping them engaged with the credit union long after their initial loan. By connecting with potential members at the point of loan origination, credit unions can create a pathway for them to access a wide range of financial services. This can significantly increase member retention, create additional revenue streams, and solidify long-term relationships.

With Origence Indirect Lending, credit unions are equipped with the digital infrastructure and speed to not only win the loan, but make a strong first impression—opening the door to deeper member engagement from day one.

Repeat business and stronger member relationships

First Financial Maryland FCU gained 1,100+ new members through indirect lending—9% used additional services.

“With the Origence indirect lending platform, we were able to onboard over 1,100 new members. And as a result, roughly 9% of them took additional services outside of their original auto loan.”

Rob Wells

Consumer Lending Manager

First Financial Maryland FCU

Why it matters

A robust indirect lending program offers an essential entry point for loyal, multi-service members. With the right indirect lending tools and strategy, credit unions can provide a more personalized, efficient experience that encourages members to engage with other services. By leveraging key insights, behavioral patterns, and data, credit unions can not only increase member acquisition rates but also ensure stronger retention by offering well-timed solutions that meet their evolving needs.

Ready to make a great first impression?

Easy onboarding

Getting started with indirect lending—or reviving a dormant program—can seem like a heavy lift. With the right support, credit unions can bypass the usual hurdles and accelerate into high-performance mode. With Origence, credit unions get more than just a platform—they get a partner. The onboarding process is designed to remove friction and accelerate results, with attentive, personalized service every step of the way.

From day one, credit unions are paired with experienced dealer reps and implementation teams who understand the nuances of indirect lending. They guide credit union staff through setup, support integrations with core systems, and help connect credit unions with key in-market dealerships—all tailored to specific goals and capacity.

Expert-led onboarding sets the stage for success

Austin Telco FCU scaled from $180K to $13.8M in indirect auto loan volume in just 4 months from onboarding.

BluCurrent Credit Union successfully restarted its indirect lending program.

CU of America maintained its position as the #1 auto lender in Kansas.

Why it matters

Successful indirect lending starts with a strong foundation. Attentive, tailored onboarding ensures credit unions are supported from day one—so teams can move faster, avoid common pitfalls, and start seeing results sooner.

Ready to get the support your credit union needs?

Expert CUSO support

A successful indirect lending program relies on more than just technology—it requires a partner who understands the credit union mission at its core. As a credit union service organization (CUSO), Origence was built by and for credit unions. That shared perspective translates into more than technical support—it brings guidance, accountability, and a genuine commitment to helping credit unions succeed.

From implementation to strategy, Origence supports every step of the lending journey with deep industry knowledge and a consultative approach. Origence doesn’t just serve credit unions—it grows with them. As a CUSO, we prioritize credit union feedback and push for advancements that align with their goals. Whether it’s improving workflows, expanding integrations, or enhancing the member experience, our roadmap is shaped by the voices of the credit unions we serve.

Support rooted in shared purpose

SunWest Credit Union found value in Origence’s credit union-first approach and focus on long-term relationships.

First Financial Maryland FCU credited Origence’s consultative support for helping them quickly ramp up indirect lending operations.

Honor CU turned feedback into progress with Origence.

Why it matters

When credit unions partner with a CUSO, they gain more than a vendor—they gain a team that listens, evolves, and shares their values. Origence’s ongoing collaboration with credit unions helps drive meaningful innovation while ensuring solutions stay rooted in the realities of day-to-day lending. That shared commitment creates lasting value—not just for credit unions, but for the members they serve.

2023 CUSO of the year

Origence is honored to be recognized by NACUSO for distinguished service to credit unions.

Key takeaways

Origence Indirect Lending gives credit unions the power to grow strategically—expanding reach, improving processes, and building deeper relationships across the lending marketplace. With advanced automation, AI-driven decisioning, and access to the largest credit union dealer network in the nation, Origence helps credit unions compete more effectively in today’s fast-moving market.

With Origence, credit unions can:

- Increase loan volume without overextending staff or resources.

- Improve decisioning and processing speed through AI and automation.

- Raise look-to-book ratios by targeting high-quality applications.

- Simplify the onboarding and integration process.

Build stronger dealer partnerships with faster funding and broader reach. - Turn indirect borrowers into long-term, multi-service members.

Take the next step

Whether starting fresh, optimizing an existing program, or looking to remove operational friction, Origence delivers the technology and partnership support credit unions need to move forward with clarity and control.

Let’s take a look at the possibilities, together.