Originate loans and accounts on a single platform

Transform the lending journey for your members and staff, from application to closing—and every step in-between.

Stay ahead of the curve with Origence arc OS

Faster and more efficient lending

Best-in-class decision engine

Next generation automation & AI

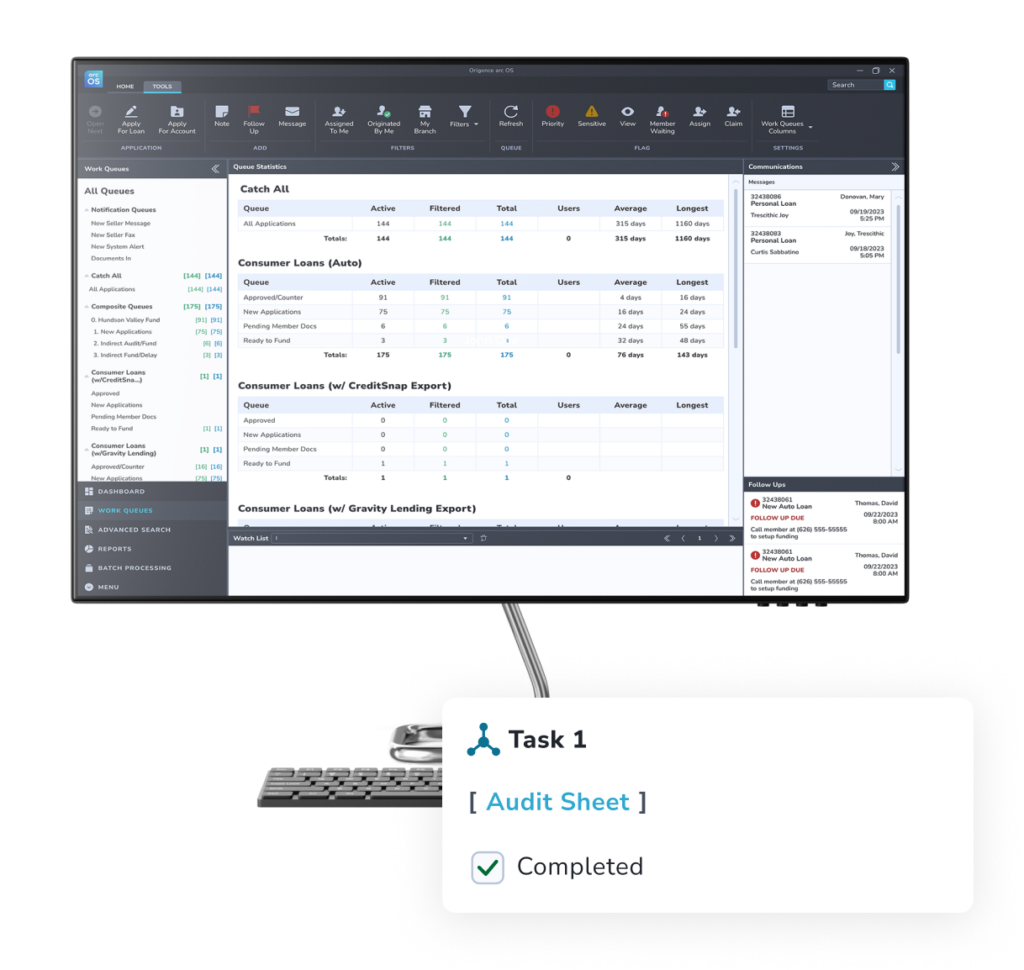

Empower your team with low-code automated workflows

- Low-code workflow automation to easily scale and adjust workflows without IT or engineering support

- Efficiently manage your team and process with role-based queues that assign tasks based on set roles

- Facilitate cross-departmental collaboration with the ability to have multiple team members viewing loan apps at once

- Set up a custom workflow with rules, tasks, and stipulations that reflect your business processes

Credit union success stories

Hear leaders of TelComm Credit Union, Patelco Credit Union, and Truity Credit Union share how their teams leverage faster decision-making, enhanced workflows, seamless origination, and streamlined underwriting with Origence arc OS.

Hear Leonard Salazar, AVP of consumer and indirect lending of Southland Credit Union, highlight key decision factors that led to a successful partnership with Origence. Learn more about Origence’s digital solutions designed to advance today’s leading credit unions.

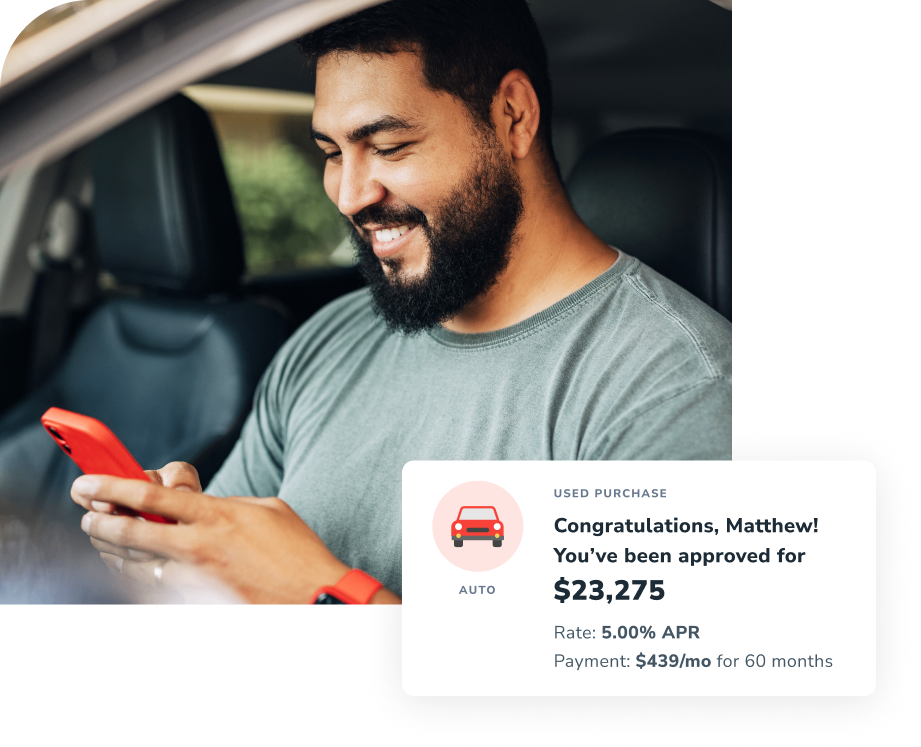

Deliver a true digital experience

Offer a modern member experience with Origence arc DX: the perfect digital companion for Origence arc OS

Modern digital operations

Integrated platforms

Layered fraud mitigation

The all-in-one origination solution that grows with your needs

Multiple loan and account types

Open new accounts and originate consumer loans and HELOCs on a single platform.

Deep network of partners & integrations

Tap into rich integrations with market-leading host providers, credit bureaus, fraud providers, eSignature solutions, and more.

Popular loan type features

Here’s an overview of just a few of the key features for our most popular loan types.

- Completely redesigned HMDA support including downloadable LAR report

- Fully integrated flood and AVM services

- New digital experience allows the member to enter demographic, property, and lien information from their computer, tablet, or mobile phone

- Real-time valuations on autos, motorcycles, RVs, boats, and watercraft

- Seamless integration with CarFax for title history

- Quote and retrieve agreements from top GAP and warranty providers

- Leasing support through integration with CULA

- Integrated with major host and credit card servicing systems

- Create accounts and order cards

- Supports instant issuance & balance transfers

- Create a variety of personal loan types

- Include recurring payment skips, balloon loans, teaser interest rates, and more

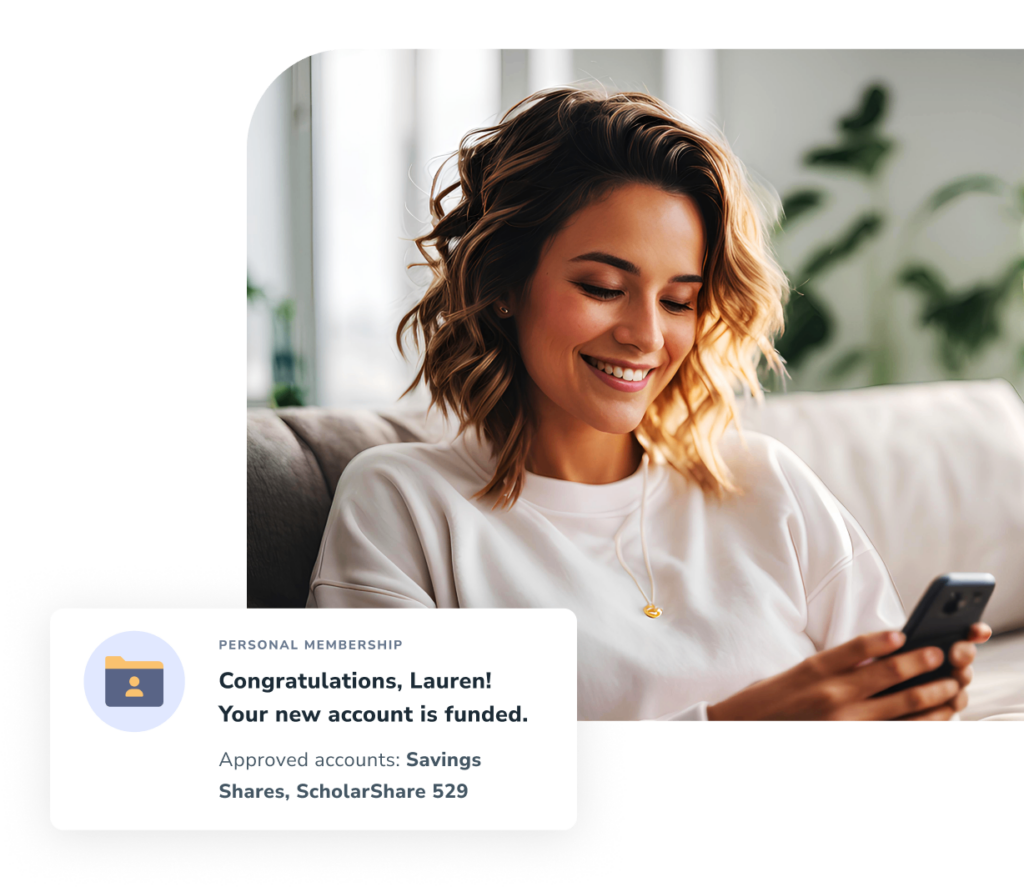

Powerful deposit account opening built in

Open new membership accounts online, in less than 6 minutes.

Integrated loan & account membership experience

Fully digital via mobile, desktop, laptop or tablet

Layered fraud mitigation

Rich third-party integrations

Optimize your operations

Data-driven consulting

Full-service loan processing

We're here to help.

Learn more about growing and modernizing your lending operations.