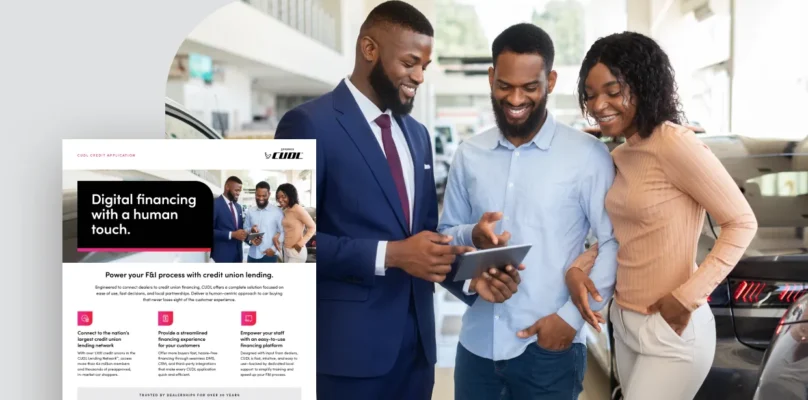

Deliver a personalized member experience across all touchpoints.

Help members effortlessly open deposit accounts, apply for loans, and join your credit union—online, anytime.

Turn your digital member experience into a competitive advantage.

Elevate your digital member experience.

Employ our online banking and core integrations for a seamless digital account opening and consumer lending experience.

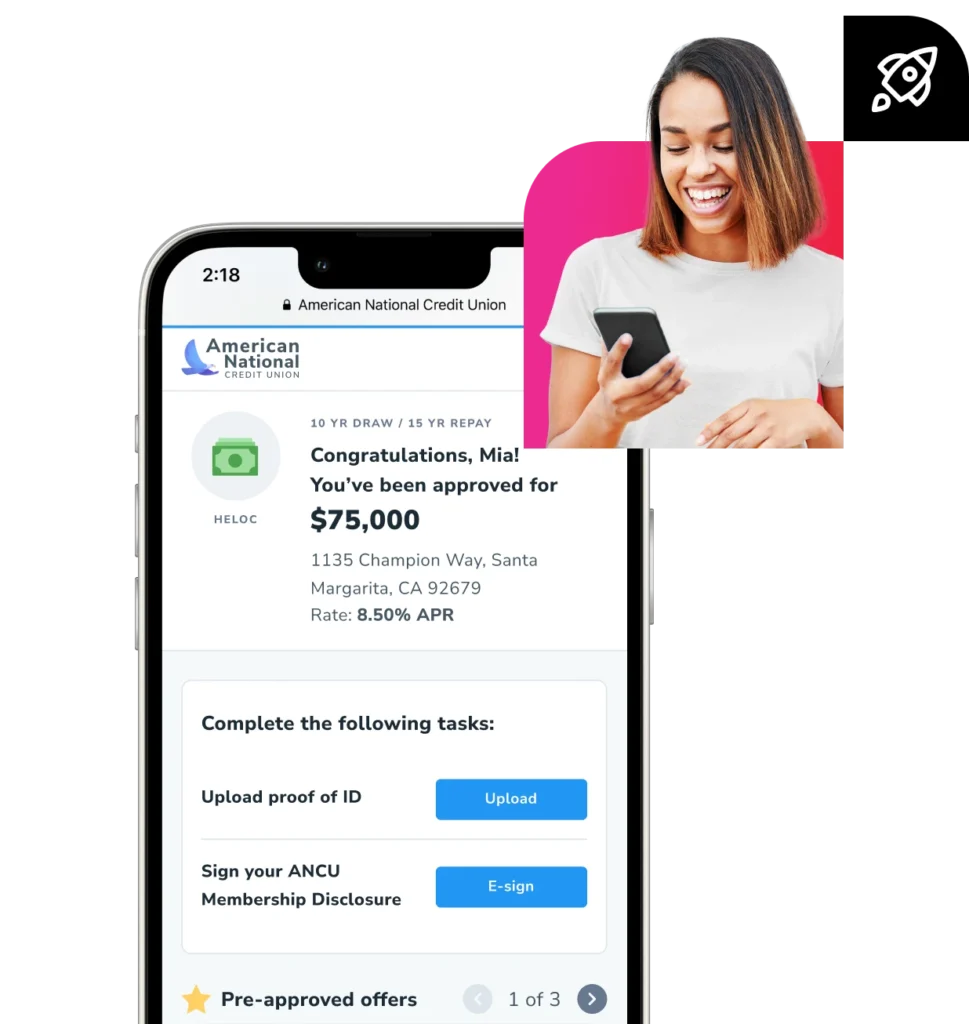

Deliver a complete digital journey.

Members can apply, finalize loans and deposit accounts, satisfy stipulations, and e-sign all on a single platform.

Personalize lending with a click.

Leverage application prefills with host banking, core, and 3rd party database integrations.

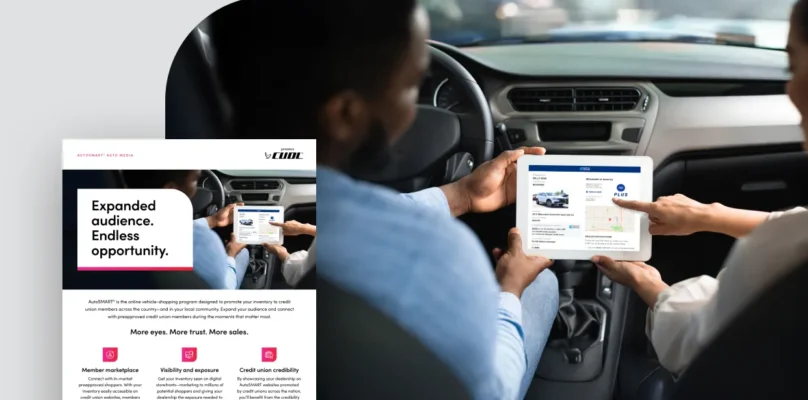

Be everywhere, all at once.

Offer your members a true omni-channel solution with online, SMS, and in-branch services that stay consistent through the experience.

For every step of the digital journey

- Status updates, reviews and notifications

- Upload documents

- Real-time decisioning

- Embedded eSign functionality

- Integrated same-session account funding

- Personalized cross-sell capabilities

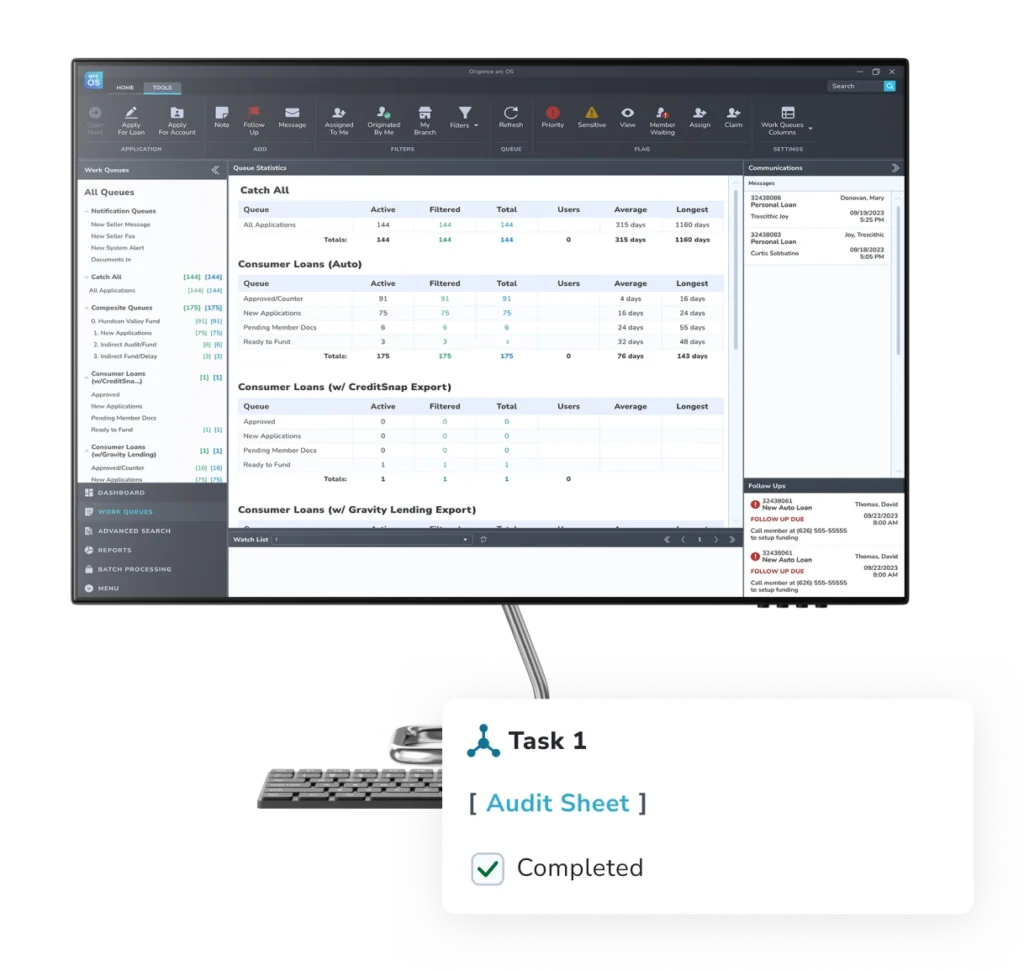

In perfect harmony with arc OS origination

Origence arc DX integrates seamlessly with Origence arc OS for a true end-to-end origination platform that covers the entire member origination journey. Featuring automated underwriting, drag and drop workflow configurability, an AI-driven decision engine, and a deep library of modern integrations, arc OS brings everything together in a powerful single platform origination solution.

Anywhere, anytime online applications

Extend your lending and deposit account services online, while maintaining complete control over your online applications with brand-configurable capabilities.

- Versatile across multiple devices: desktop, laptop, tablet, and mobile

- Optimized for mobile responsiveness on major browsers

- White-labelled to manage your brand, voice, and tone

- Customizable application templates and content editors

- Streamlined with integrated pre-fill and single sign-on options

- Differentiated new member vs. existing member experiences to optimize efficiency

No paper, no manual entry, and no overhead costs

We’ve integrated digital account opening, membership applications, and consumer lending origination all within the arc DX experience. It’s your reliable solution to onboarding with no paper, no manual entry, and no overhead costs.

High accuracy and immediate results

Identity verification and fraud protection are carefully supported through third-party integrations to ensure the highest quality of accuracy while providing immediate results. Including but not limited to: Equifax Instatouch, Experian’s precise ID® (out-of-wallet questions), FIS Decision Solutions (QualiFile, ID Verification, OFAC), as well as SWBC’s Electronic CashManagement (ACH transactions and credit/debit card funding).

Your lending partner—even when you’re off the clock

Insights that move lending forward.

-

-

arc DX: Deliver a personalized member experience across all digital touchpointsDownload now

-

Turn digital touchpoints into lasting member relationships.

Create frictionless, digital lending and onboarding experiences designed to keep members engaged and position your credit union for long-term success.