Your indirect lending strategy, optimized to perform.

One platform. Your rules. Real growth.

With 1,100 credit unions and 20,000 dealers on a single, powerful platform, CUDL delivers the speed and control you need to grow your indirect lending.

Retain more member loans.

Fast preapprovals and funding, supported by visibility at every stage of the lending process.

Lower indirect origination costs.

With no per app fees, you only pay for the loans your credit union funds.

Maintain complete control.

From dealer selection to underwriting strategy and decisioning, you set the rules.

Tap into today’s technology.

A modern lending infrastructure powered by smart automation, AI, and 100+ integrations.

Connect coast to coast with 20,000 dealers.

- You choose which dealers you want to work with

- Individual dealer agreements not required

- Dealer Scorecard displays performance metrics for every dealer in your curated network

- Easily expand and contract dealer network based on your indirect lending strategy

- Local client support provided to help you nurture dealer relationships

Drive new lending opportunities and build strong dealer connections.

Auto dealers nationwide

Credit union partners

Indirect loan funding in 2025

Total indirect loans funded as of 2025

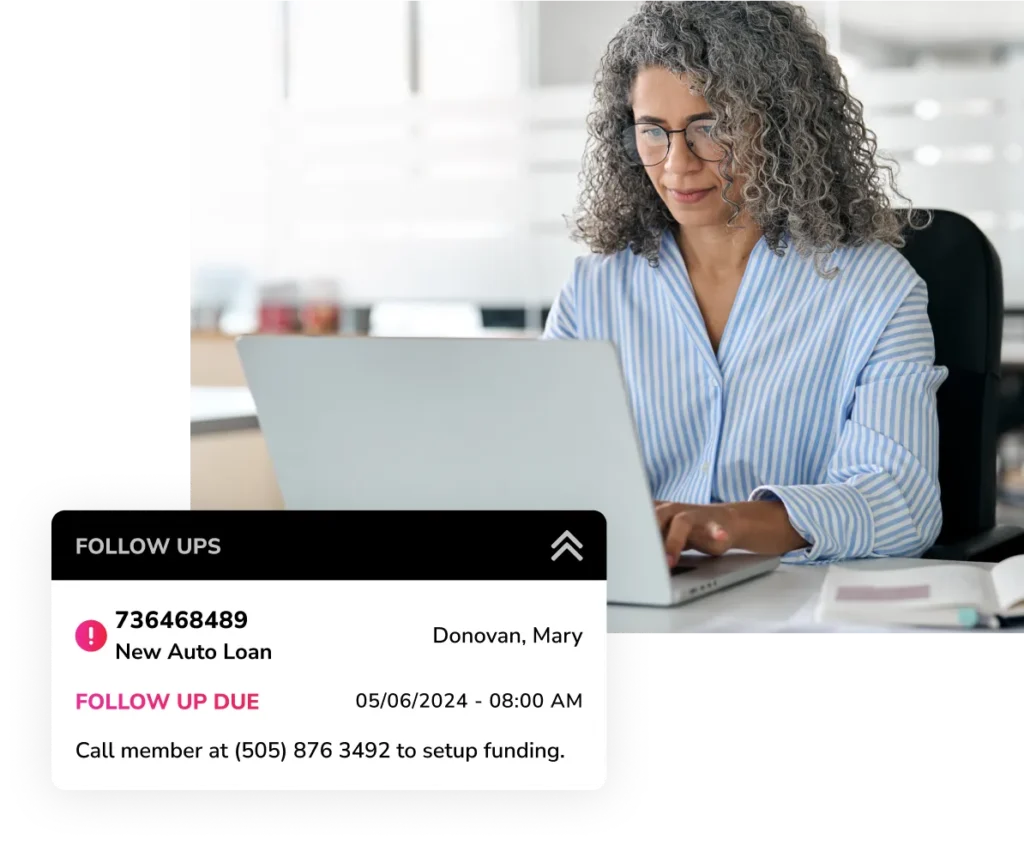

Originate indirect loans and accounts on a single, flexible platform.

With CUDL, you’ll have access to the indirect lending module of our loan and account origination system, arc OS indirect—or integrate with your existing LOS.

Automated loan decisioning

Stay in control of underwriting with a built-in decision engine using 1,800 variables to support your strategy.

Seamless connectivity across your partner network

Connect with major core processors, credit bureaus, ID verification providers, eSignature solutions, and more.

Powerful deposit account opening

Open new membership accounts online in less than 6 minutes—giving new members a great first impression.

Digital capabilities to transform your indirect lending operations.

Document Processing Automation (DPA)

Leverage machine learning and advanced AI for faster document processing, verifications, and lending package delivery.

- Automate busywork: Less keying, fewer exceptions.

- Boost throughput: Handle spikes without extra headcount.

- Improve quality: Consistent extraction and checks across files.

eContracting for CUDL®

Go from approval to booked loan in fewer steps with the only digital contracting solution built specifically for CUDL.

- Cleaner packages: Standardized, digital, and accurate.

- Faster funding: Reduced back-and-forth and fewer delays.

- Improved dealer satisfaction: Less paper, less hassle, and smoother post-sale processes.

- Enhanced member experience: Fast, digital signing—in-person or remote—for a modern, frictionless loan close.

Trusted by credit unions. Proven to deliver results.

Discover how Origence CUDL helps credit unions grow auto loan volume, improve operational efficiency, and deliver exceptional member experiences.

The complete solution for next-generation indirect lending.

Discover how Origence CUDL helps credit unions grow auto loan volume, improve operational efficiency, and deliver exceptional member experiences.

Intelligent Underwriting Technologies

Deliver instant, data-driven loan decisions with integrated AI technologies that optimize accuracy, speed, and growth.

SmartFund®

Digitize funding workflows to accelerate speed, replacing manual steps with AI-powered document automation.

AutoSMART®

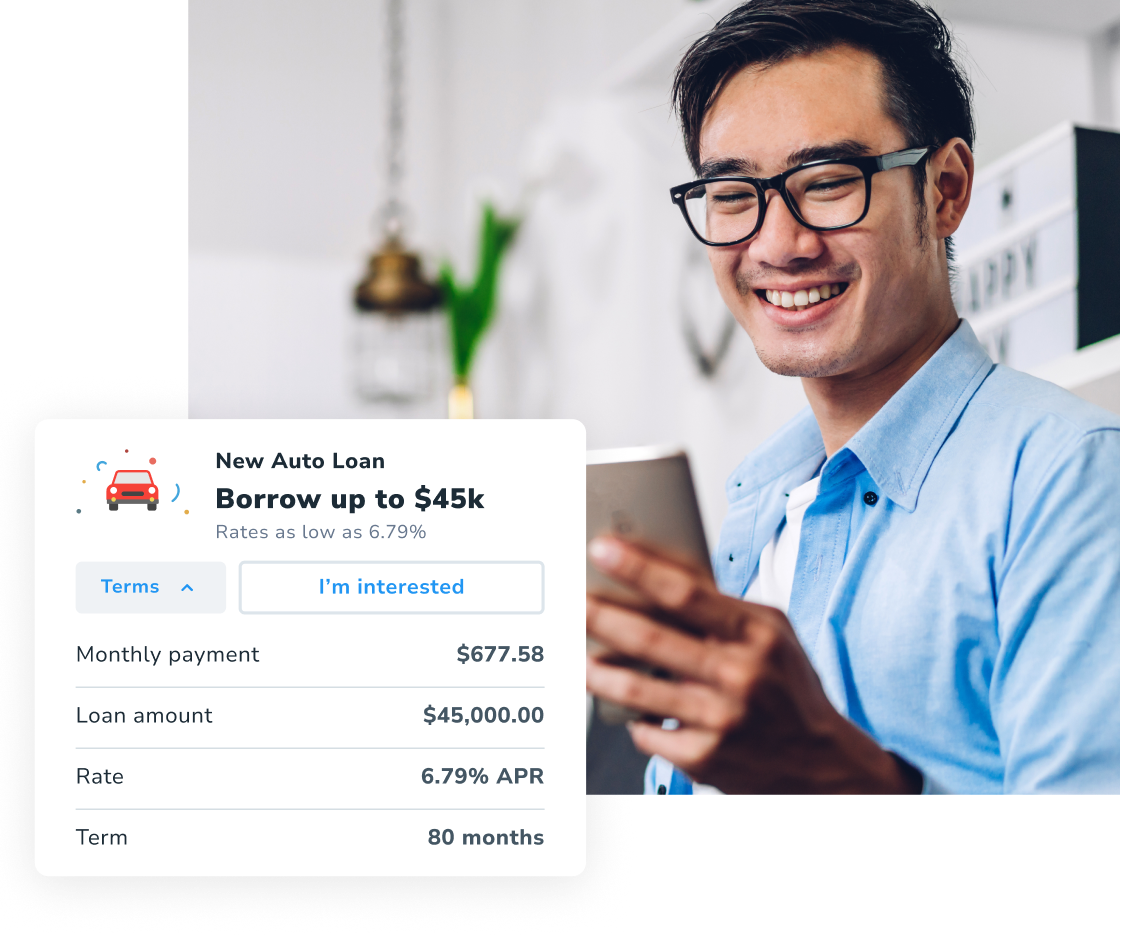

Provide a seamless online car-buying journey that connects members to financing through your credit union website.

Smart Approval

Offer 24/7 preapprovals through your website and create a seamless digital lending experience from the very first click.

NEW! Credit Application Update

Simplify your review process. Dealers can update existing applications without starting over—reducing duplicates and errors. Better data in. Better decisions out. Fewer back-and-forths. Faster approvals. No contract changes or added cost.

Scale faster with strategic services

built for credit unions.

Partner with experts who turn the complexities of indirect lending into a clear, streamlined path to success. Explore key services designed to help credit unions build stronger dealer relationships, operate more efficiently, and sustain top-tier lending performance.

More lending power, same team.

Scale your lending without stretching your team or adding headcount. Serve more members, move loans faster, and keep service levels high.

- Loan processing services

- Underwriting services

- Document services

- Call services

- Letter services

Guidance that drives results.

Work with advisors you know and trust, to help your credit union enhance efficiencies, improve ratios, and optimize portfolio performance.

- Decision engine optimization

- Benchmark Report

- Portfolio stratification

- Stress testing

- Predicted performance analysis

- Dealer performance review

- Competitive analysis

Fast, reliable credit data.

Receive easy access to credit reports and verifications leveraging Origence’s preferred partnerships with top credit bureaus.

- Consumer credit reports

- FICO® risk scores

- Fraud solutions

- VantageScore®

Ready to grow indirect your way?

Discover how Origence can help your credit union fund more loans, streamline operations, and deliver standout member experiences.

Insights that move lending forward

-

-

-

Arizona Central CU: Turning unified workflows into faster lending performanceWatch now